Business Insurance in and around Colorado Springs

One of Colorado Springs’s top choices for small business insurance.

Almost 100 years of helping small businesses

- Colorado Springs

- Falcon

- Peyton

- Denver

- Woodland Park

- Aurora

- Broadmoor

- Castle Rock

- Vail

- Fort Collins

- Lakewood

- Thornton

- Arvada

- Westminster

- Pueblo

- Centennial

- Greeley

- Boulder

- Highlands Ranch

- Longmont

- Loveland

- Broomfield

- Parker

- Security-Widefield

Your Search For Remarkable Small Business Insurance Ends Now.

Running a small business comes with a unique set of wins and losses. You shouldn't have to deal with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including business continuity plans, a surety or fidelity bond and errors and omissions liability, among others.

One of Colorado Springs’s top choices for small business insurance.

Almost 100 years of helping small businesses

Protect Your Future With State Farm

Whether you own an ice cream shop, a bakery or a barber shop, State Farm is here to help. Aside from remarkable service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by calling or emailing agent Peter Martinez's team to explore your options.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

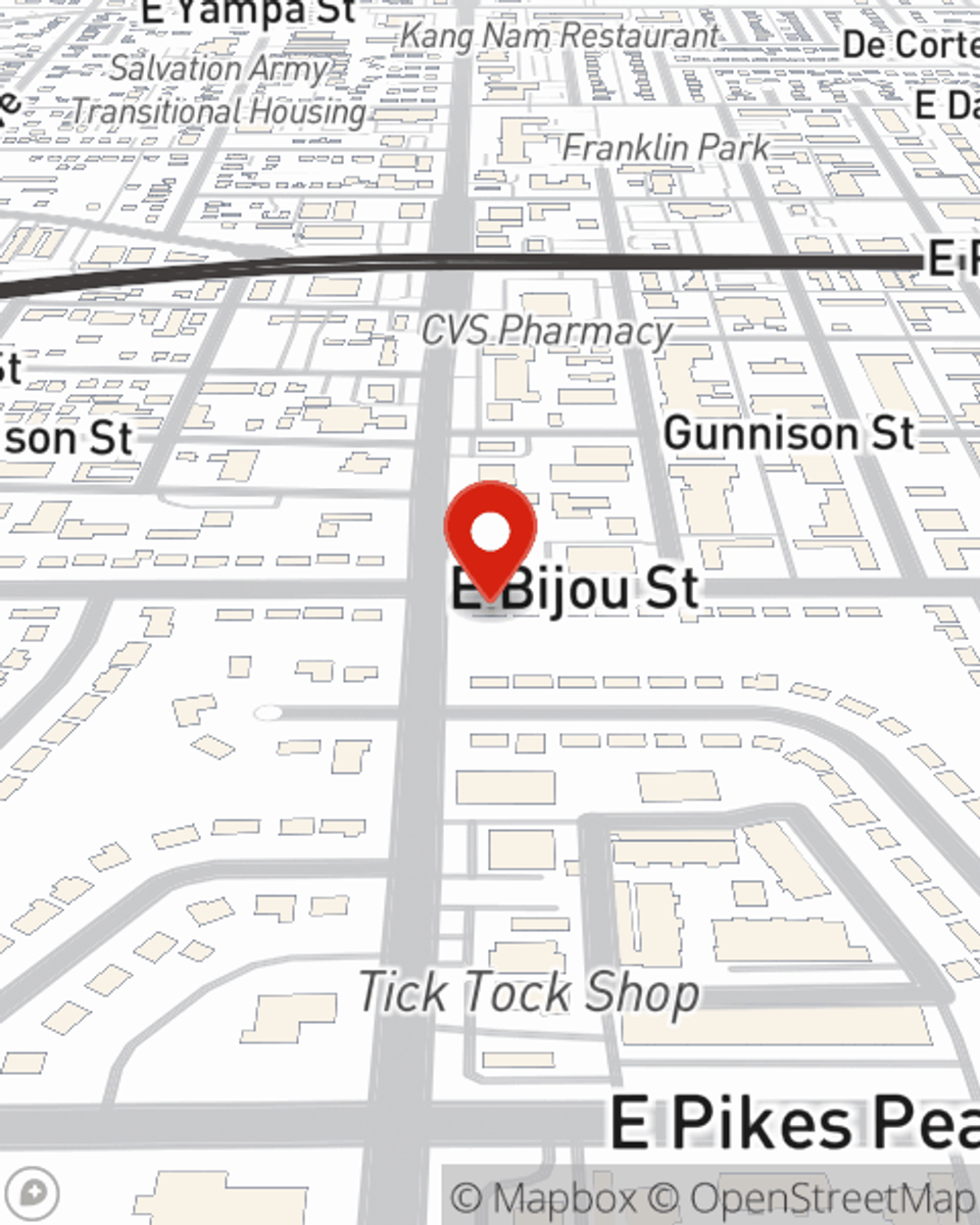

Peter Martinez

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.