Life Insurance in and around Colorado Springs

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

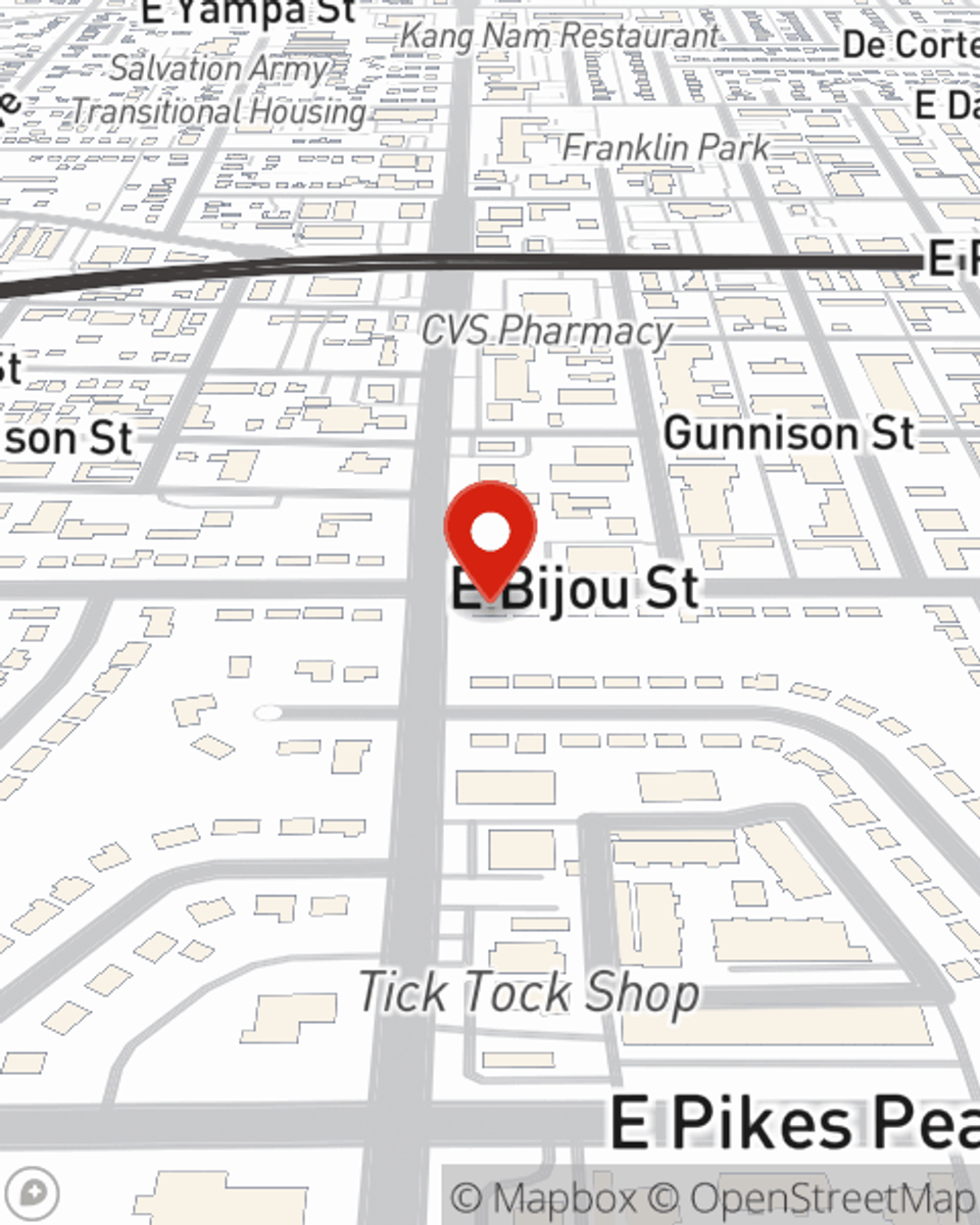

- Colorado Springs

- Falcon

- Peyton

- Denver

- Woodland Park

- Aurora

- Broadmoor

- Castle Rock

- Vail

- Fort Collins

- Lakewood

- Thornton

- Arvada

- Westminster

- Pueblo

- Centennial

- Greeley

- Boulder

- Highlands Ranch

- Longmont

- Loveland

- Broomfield

- Parker

- Security-Widefield

State Farm Offers Life Insurance Options, Too

Do you know what funerals cost these days? Most people aren't aware that the typical cost of a funeral today is $8,500. That’s a heavy burden to carry when they are grieving a loss. If the ones you leave behind cannot manage that expense, they may fall into debt in the wake of your passing. With a life insurance policy from State Farm, your family can maintain their quality of life, even without your income. Whether it pays for college, keeps paying for your home or maintains a current standard of living, the life insurance you choose can be there when it’s needed most by your loved ones.

Insurance that helps life's moments move on

Life happens. Don't wait.

Colorado Springs Chooses Life Insurance From State Farm

And State Farm Agent Peter Martinez is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Interested in seeing what State Farm can do for you? Get in touch with agent Peter Martinez today to get to know your personalized Life insurance options.

Have More Questions About Life Insurance?

Call Peter at (719) 633-0300 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Peter Martinez

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.